Nov 19, 2025

The Saudi Trade and Investment Commitment to the United States in Perspective

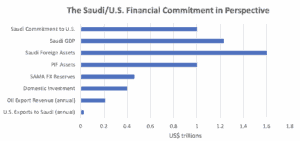

The $1 trillion Saudi trade and investment commitment to the United States will be extremely difficult to achieve given the size of the Saudi economy and its current financial situation.

At their White House meeting on November 18, Crown Prince Mohammed bin Salman and President Donald J. Trump announced that Saudi Arabia would increase its trade and investment commitment to the United States to $1 trillion from the previously announced $600 billion. The trade and investment agreements being made reflect the increasing alignment of the two countries’ strategic economic priorities. Saudi Arabia is seeking foreign investment and advanced technology from the United States to help accelerate its Vision 2030 reforms, while the United States is seeking to tap into Saudi Arabia’s financial resources to boost investment, jobs, and growth in its own economy.

$1 Trillion in Perspective

There is little doubt that trade and investment ties between the United States and Saudi Arabia will increase over the next few years. The question is whether the scale of Saudi Arabia’s $1 trillion commitment is achievable given the size of its economy and its current financial situation.

Source: Author calculations

Saudi Arabia is a rich country, but $1 trillion is a lot of money to come up with. While it is not clear over what period the commitment is expected to be met, the scale of the commitment relative to the size of the Saudi economy means that it will be extremely difficult to achieve even over a number of years. To put the commitment in perspective, it represents:

- 80% of Saudi Arabia’s annual economic output (nominal gross domestic product is forecast by the Ministry of Finance to be $1.23 trillion in 2025).

- Three times the annual capital investment in the Saudi economy ($370 billion over the past year).

- Nearly five times Saudi Arabia’s annual oil exports ($210 billion during the past year).

- 40 times annual U.S. exports of goods and services to Saudi Arabia ($26 billion over the past year).

- About two-thirds of Saudi Arabia’s total foreign asset holdings ($1.6 trillion).

- The Public Investment Fund’s assets under management (expected to be around $1 trillion at the end of 2025).

- More than twice the Saudi central bank’s foreign exchange reserves ($450 billion).

Low Oil Prices a Barrier to Large Investments

The Saudi fiscal and current account balances are both in deficit and will remain there while oil prices remain at current levels. The financing of new trade and investment commitments will therefore need to come from the sale of existing assets or increased borrowing. Both are likely. Relatively low public sector debt means that investor appetite for Saudi paper remains robust while the PIF has some attractive assets to sell. Nevertheless, demand for Saudi debt is not unlimited, and asset sales may be complicated by the relatively poor recent performance of the domestic equity market.

The current low oil price environment means that a smaller pot of money is available to meet a broadening list of demands on Saudi financial resources. It appears that several domestic projects are now being reviewed and potentially scaled back. While oil prices remain low, the Saudi authorities will continue to face difficult choices, as they seek to balance their own domestic investment priorities under Vision 2030 with the financial commitments they have made to the United States and the likely requests they will receive for financial support from countries in the region.

The views represented herein are the author's or speaker's own and do not necessarily reflect the views of AGSI, its staff, or its board of directors.