Aramco and the Saudi Government Budget

Payments by Aramco are still the key driver of government revenue in Saudi Arabia despite the notable increase in non-oil revenue, particularly from the value-added tax, in recent years.

9 min read

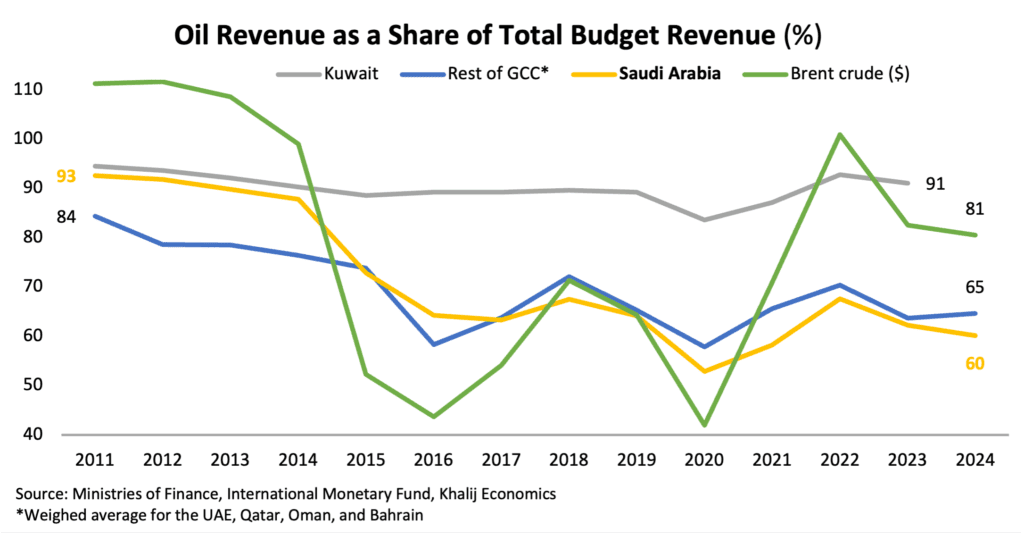

The profitability of Aramco, the Saudi national oil company, is vital to the health of the government budget and the broader economy. Over the past three years, revenue from oil accounted for 63% of total government fiscal revenue. While this share of revenue from oil is still substantial, it is significantly lower than it was a decade ago (88% in 2014) due to lower oil prices and the introduction of taxes, such as the value-added tax. It is also lower than in most other Gulf Cooperation Council countries.

Understanding the relationship between Aramco and the Saudi government budget is necessary to accurately forecast fiscal outcomes in the kingdom. Luckily, the flow of revenue from Aramco to the government budget has become more transparent with the heightened financial disclosures that are being made by the company following its public listing on the Saudi stock exchange in December 2019. Digging into Aramco’s financial statements helps provide greater clarity on the mechanisms through which oil revenue is received by the budget and makes it clear that there is no simple linear relationship between oil prices and government fiscal revenue.

Aramco and the Government Budget

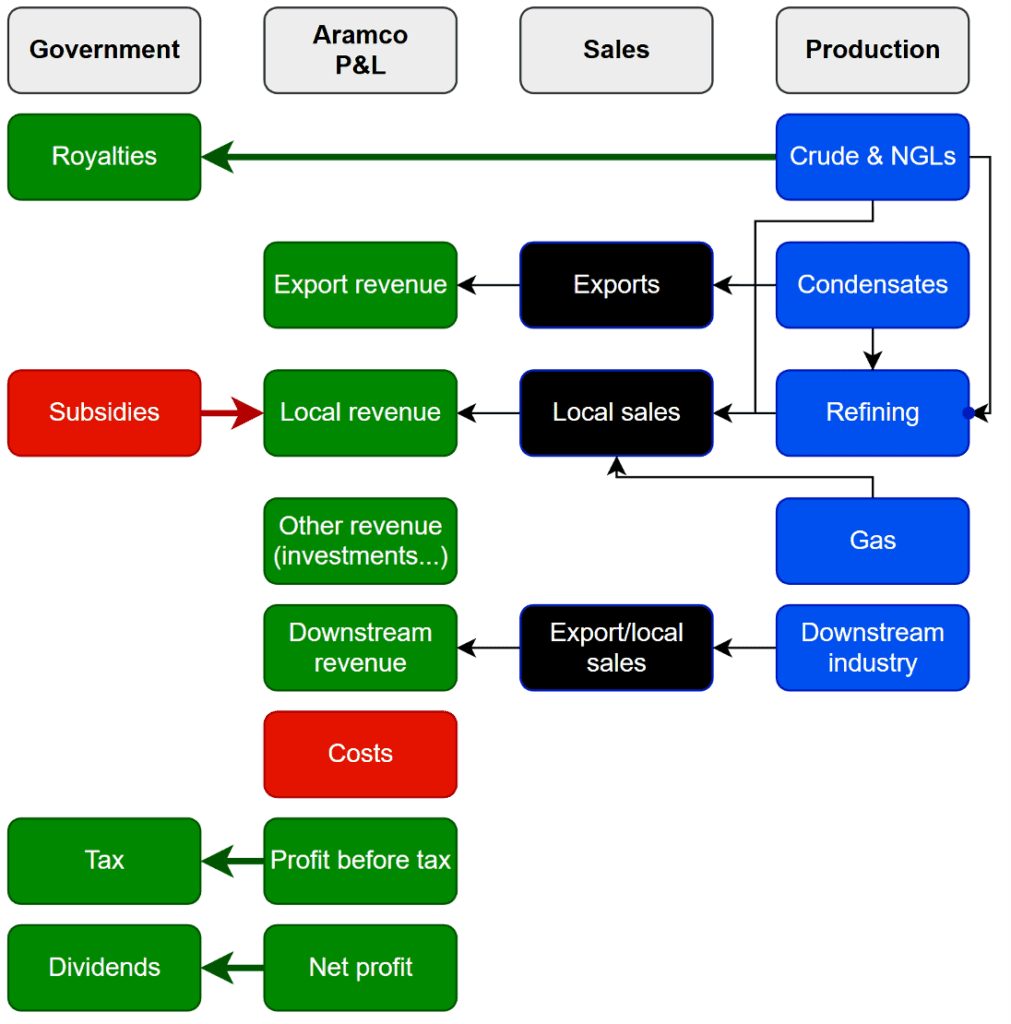

Aramco generates its revenue from five main sources: (i) exports of liquids (crude and refined oil and natural gas liquids); (ii) domestic fuel sales; (iii) domestic gas sales; (iv) exports and domestic sales of petrochemicals and other downstream activities; and (v) returns on domestic and foreign investments. The company’s expenses consist of operational costs and capital investments in oil, gas, alternative energy, and downstream activities.

Aramco has always made large payments to the government budget, but the way these payments are structured has changed to make Aramco’s accounts more easily comparable to international oil companies’ and to thereby increase its appeal to potential investors. Aramco’s payments to the government include royalties, taxes, and dividends (received by all investors). In recent years, dividend payments have increased, and royalty and tax rates have been reduced.

Aramco’s Operations and Payments to the Government

Sources: Aramco financial statements

Royalties: These are directly linked to the volume of oil production and are paid as a percentage of the price of a barrel of oil. The royalty formula has changed several times and is currently set so that the government receives a larger share of the value of a barrel of oil at higher prices. The government receives 15% on the first $70 per barrel, but when the price goes above that threshold, the government receives 45% of the difference when the price is between $70/bbl and $100/bbl and 80% when the price is above $100/bbl. This means that the royalty paid to the government when prices are $90/bbl, for example, is nearly double that of when they are at $70/bbl. There is a one-month lag between production and royalty payments.

Income Tax: Aramco’s income is taxed at 50% on its upstream business and 20% on its downstream business. It also pays zakat (an assessed charitable obligation under the pillars of Islam) on the value of its holdings of domestic listed companies, such as SABIC. These payments are a very small part of Aramco’s tax bill relative to income taxes.

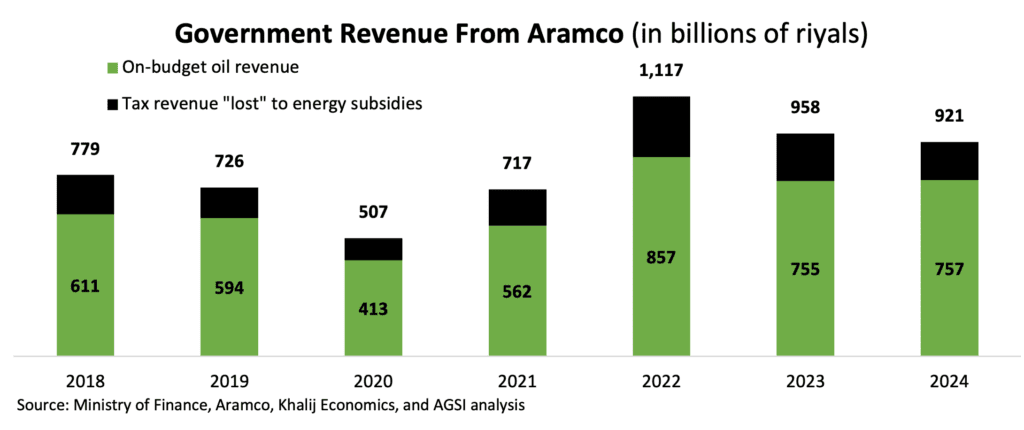

Subsidies: Saudi Arabia heavily subsidizes the price of energy products sold domestically. Aramco receives compensation payments from the government for its loss of revenue from these sales at below market prices. Aramco’s accounts include the compensation payments as “other income related to sales” in the income statement, and then Aramco deducts the compensation payments from its income tax liabilities due to the government. The deductions totaled $44 billion (164 billion Saudi riyals) in 2024, equivalent to 3.5% of gross domestic product or 11% of government expenditure. Without the deduction, the income tax paid to the government would have been roughly twice as large, and government oil revenue would have been 22% higher. The compensation payments are a good approximation for the cost of domestic energy subsidies, although the precise formulas used to calculate them are not known.

Dividends: Aramco started paying dividends to shareholders ahead of its initial public offering, and they have grown in importance as a source of government revenue since. During 2017-18, dividends comprised 36% of the oil revenue reported in the budget outturn, but their share rose to 48% from 2020-24. The company declares dividends each quarter and provides guidance to investors on the anticipated level each year, which it has always met or exceeded. The company pays a base dividend and, since the third quarter of 2023, has paid an additional performance dividend based on a formula related to its free cash flow. This performance dividend was initially designed to distribute the windfall that Aramco received from the sharp increase in oil prices in 2022. In 2024, total dividends paid to shareholders were a record $124 billion (465 billion riyals). The performance dividend declared for 2025, however, has been far lower than that for the third quarter of 2023 through the fourth quarter of 2024 because of the recent drop in free cashflow. In the first quarter of 2025, the performance dividend was just 1% of the total dividend paid compared with nearly one-third in the previous six quarters. Aramco’s guidance to investors that it will pay $85 billion (319 billion riyals) in total dividends to be paid in 2025 implies only a very small performance component, which makes sense given the decline in oil prices. Meanwhile, the government’s stake in Aramco, and hence its share of the dividends paid, has declined to 81.5% from 100% before the 2019 IPO because of its transfer of 16% of Aramco’s equity to the Public Investment Fund and the sale of 2.5% of the company to other investors through two public share offerings.

The oil revenue reported by the Ministry of Finance in the government budget and the payments to the government reported in Aramco’s financial statements do not match perfectly. This is sometimes due to timing differences, notably in the second half of 2023, when over one-quarter of the third quarter payment by Aramco was not incorporated into the fiscal accounts until the fourth quarter. Aside from the timing issues, there appears to be around $2.6 billion (10 billion riyals) a year in fiscal oil revenue that comes from sources other than Aramco. This revenue is probably related to the shared oil fields in the Saudi-Kuwaiti Neutral Zone, which are operated by Saudi Chevron rather than Aramco.

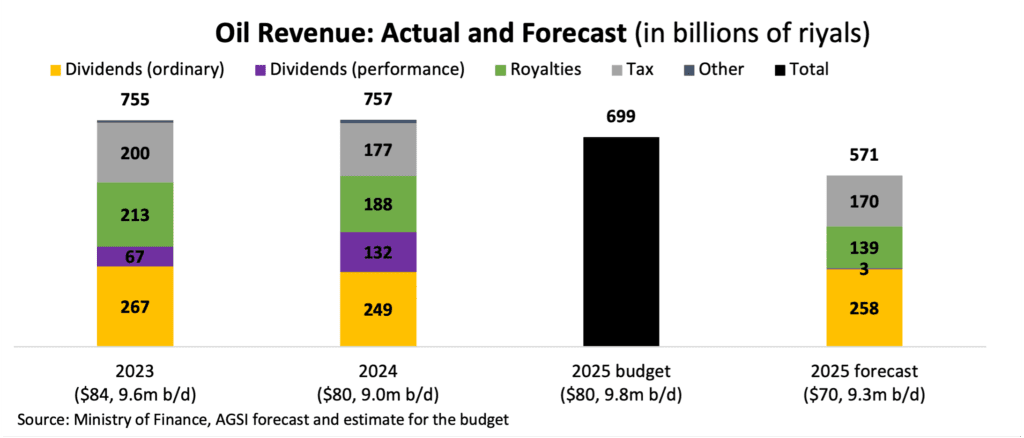

What Does This Mean for the 2025 Fiscal Outturn?

The Ministry of Finance does not disclose the oil revenue projection in the 2025 budget or the assumptions about oil prices and oil production. However, with confidence it can be estimated that the budget assumed oil revenue of about $186 billion (699 billion riyals) based on oil prices averaging $80/bbl and oil production averaging 9.8 million barrels per day. This takes into account OPEC+ plans and the oil price outlook in September 2024, when the prebudget statement was compiled (revenue projections in the budget were unchanged from the prebudget statement). It also assumes that non-oil nontax revenue (which is aggregated with oil in the budget numbers) is unchanged in 2025 relative to 2024.

Since the budget was compiled, there have been a series of modifications to the OPEC+ production plans. The current plan would see Saudi oil output increasing by an average 333,000 b/d in 2025 (relative to 2024) to 9.3 mb/d. The forecast scenario sketched out below is based on this plan and assumes that oil prices average $70/bbl during 2025. Aramco is also expected to face slightly higher costs, which reduce its profitability and hence the taxes it pays. The government’s share of the dividend in 2025 will be $70 billion (261 billion riyals). A lower average oil price in 2025 (it was nearly $80/bbl in 2024) will result in lower royalties – the average oil price of $70/bbl still includes some months when the price is above $70/bbl, and the 45% royalty rate applies. Profits and hence income tax payments will also decline. In this scenario, oil revenue will be around $152 billion (571 billion riyals), one-quarter less than in 2024.

If non-oil revenue in 2025 grows in line with nominal non-oil GDP, and government expenditure mirrors the budget estimate, this forecast would imply a budget deficit of $49 billion (184 billion riyals; 4% of GDP) in 2025 compared to a budget estimate of $27 billion (101 billion riyals; 2.3% of GDP). If spending exceeds the budget target, which looks likely after the first quarter outcome, the deficit will be larger, perhaps as high as 6% of GDP if nominal spending is unchanged relative to 2024. Last, if oil prices were to average $75/bbl in 2025, the fiscal deficit would be in the range of 2.8% to 4.8% of GDP, but if oil prices were to average $65/bbl, the deficit would come in between 4.5% and 6.5% of GDP (with both ranges again depending on the extent of expenditure control during the remainder of the year).

The views represented herein are the author's or speaker's own and do not necessarily reflect the views of AGSI, its staff, or its board of directors.